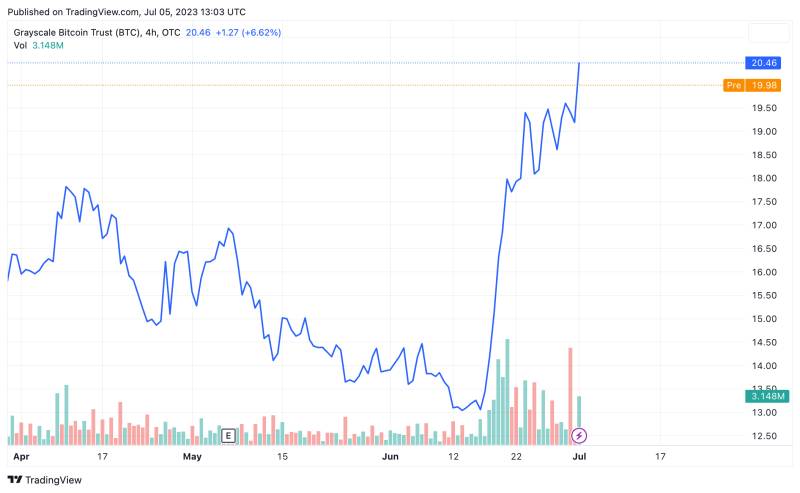

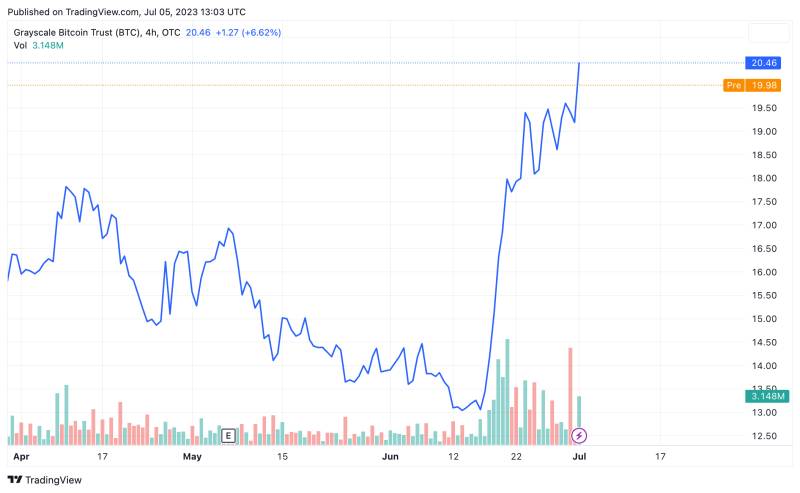

GBTC has continued to rise since the BlackRock ETF filing as its discount to NAV falls below 30%.

The Grayscale Bitcoin Investment Trust (GBTC) has risen by 57% since asset management giant BlackRock filed for a spot bitcoin ETF on June 15.

Shares in Grayscale’s flagship Bitcoin Trust rose from $13 on June 15 to trade at $20.46 today, according to data from TradingView. In comparison, bitcoin rose 21% from around $25,000 to a current price of $30,300 during the same time period.

Meanwhile, GBTC’s discount to net asset value — meaning the market price of each share is lower than the value of the bitcoin it represents — is trading below 30% for the first time since July last year. It's currently at 29.3%, according to The Block’s data dashboard.

The discount was 41.7% before BlackRock’s application and has been steadily narrowing. GBTC historically traded at a premium until 2021’s crypto credit crunch.

The U.S. Securities and Exchange Commission rejected Grayscale’s proposal to convert GBTC to a spot ETF last year, with the asset manager suing the agency over the decision. However, BlackRock’s filing, followed by applications from Invesco, WisdomTree, Valkyrie and Fidelity have renewed optimism for a conversion, potentially explaining the outperformance of GBTC.

"Grayscale's proposal to convert GBTC into a spot bitcoin ETF was rejected last year, and although Grayscale has been fighting the decision, there has been no final ruling," Rebecca Stevens, research analyst at The Block Research said last month, as the daily trading volume of GBTC began to spike following BlackRock’s filing. "Optimism around BlackRock being successful in their bid for a spot bitcoin ETF would then pave a clearer way for Grayscale to get their non-redeemable trust shares changed, too."

GBTC has also pushed higher than bitcoin year-to-date, up 144.3% compared to bitcoin’s price gain of 83.7%, according to TradingView.

source:theblock

Tue, 18 Apr 2023

Tue, 18 Apr 2023